Advertisements

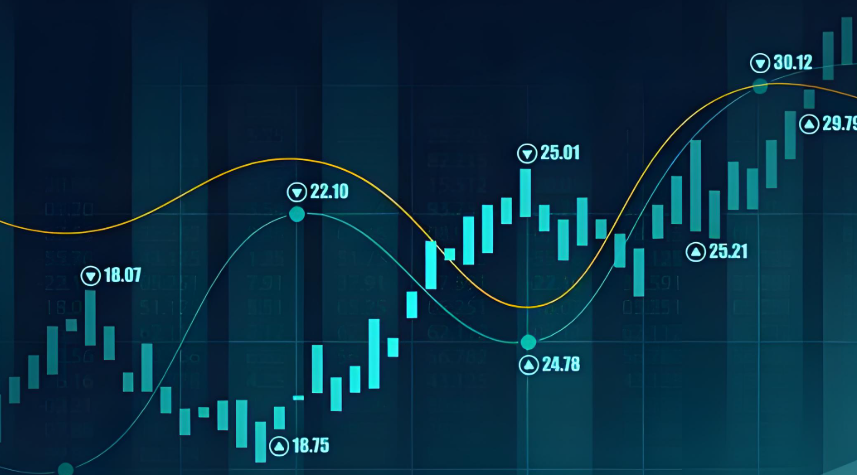

The foreign exchange market stands as a global financial hub, where myriad transactions take place every day. A key player in this intricate system is the concept of currency leverage, an invaluable tool for investors seeking to maximize their potential returns. By understanding how currency leverage works, traders can enhance their ability to capitalize on price fluctuations, albeit with an inherent risk factor that must be navigated with caution.

Currency leverage refers to the practice of borrowing funds in order to amplify the size of one's trading position. Essentially, it allows investors to use a small amount of their own capital to control a much larger position in the market. This principle is crucial in forex trading, where price swings can yield substantial profits or losses within a short time frame. For instance, consider a trader who possesses $1,000 and uses a leverage ratio of 100:1—this puts the trader in control of a position worth $100,000. Such leverage magnifies potential gains, but it also heightens the risk. Should the market move against the trader, significant losses can be incurred, sometimes exceeding the initial capital invested.

A central dynamic driving the effectiveness of currency leverage is the volatility inherent in foreign exchange rates. The exchange rate reflects the relative value between two currencies, influenced by a myriad of factors including economic indicators, geopolitical events, and market sentiment. As these variables shift, the exchange rates react, creating opportunities for leveraged traders to exploit. An example of this can be found during economic announcements, such as employment reports or interest rate changes, where sharp volatility often follows, and skilled traders can leverage their positions to capitalize on these movements.

Another aspect that plays into the dynamics of currency leverage is the country's balance of payments. When a nation experiences a surplus in its international transactions, demand for its currency will rise, and prices may jump. Conversely, a deficit can lead to lower demand and hence, a decrease in currency value. Investors utilizing leverage can position themselves to profit during such fluctuations, timing their trades strategically based on economic forecasts.

Inflation rates within a country also provide fertile ground for leveraging in forex trading. High inflation devalues a currency’s purchasing power, making it less competitive on the international stage. A classic example of this is seen in hyperinflation scenarios, where countries like Zimbabwe saw immense currency devaluation. From an investor's standpoint, recognizing such economic conditions enables savvy traders to use leverage to bet against weakening currencies, thereby securing significant profits.

Delving deeper into the mechanics of currency leverage, it becomes clear that its influence does not exist in a vacuum. The type of exchange rate regime in place significantly tailors how leverage can be employed. For instance, in a fixed exchange rate regime, currency values are pegged to a stable reference, often diminishing the frequency and degree of volatility. the effects of leverage are relatively muted in such environments. In contrast, a floating exchange rate regime can lead to frequent fluctuations, allowing leveraging traders to exploit these moments for profit. Thus, the chosen exchange rate model can dramatically reshape the landscape in which leverage is employed.

Moreover, the global standing of a country’s currency enhances the implications of utilizing leverage. Major reserve currencies such as the US dollar or the euro exhibit substantial impacts on global trade, meaning their shifts in value have pronounced consequences for international investors. For traders operating with currencies that hold lesser status, the potential for substantial movement becomes limited, reinforcing the idea that understanding market dynamics is vital for those engaging in leveraged trading.

In practice, the trading platforms available to forex traders often provide leverage ratios ranging anywhere from 50:1 to 400:1. Depending on the broker, these ratios permit varying levels of risk exposure. While high leverage can lead to magnified returns, it likewise opens the door to severe losses. Therefore, assessing one's risk tolerance is paramount when deciding on an appropriate leverage ratio.

Effective risk management strategies become critical components of trading when working with leverage. Investors must navigate this landscape with a clear approach to mitigate potential losses. Establishing stop-loss orders is a common technique employed to cap any downside risk, ensuring traders exit positions before incurring heavy losses. Similarly, setting take-profit levels serves to secure profits once predetermined targets are met. Another effective strategy is diversifying investments across various markets or currency pairs, further mitigating the risks borne from single market volatility.

In conclusion, navigating the complexities of currency leverage in forex trading is tantamount to mastering a balancing act—seizing potential opportunities while vigilantly managing the risks involved. As the global forex market continues to evolve, leveraging remains an indispensable tool for traders willing to engage in a high-stakes environment where every decision can result in significant profits or losses. By comprehensively understanding the workings of currency leverage—its relationship with economic indicators, market dynamics, and the appropriate risk management techniques—traders can traverse this financial landscape with confidence, optimizing their strategies for success in an ever-changing market scenario.

Ultimately, the synergy of sound leveraging strategies and effective risk management can lead forex investors to thrive amidst the uncertainties, positioning them to sail through both turbulent and prosperous financial waters ahead.

Popular Posts

January 9, 2025

October 29, 2024

December 22, 2024

October 19, 2024

January 1, 2025

December 13, 2024

November 3, 2024

November 17, 2024

October 13, 2024

December 25, 2024

Post Your Comment